The Case for Dividends

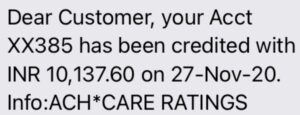

Would it not be good to get this kind of a message on your phone? This is the message you get when the dividend gets credited to your account.

Welcome to harnessing the power of dividends as an additional source of Income.

Mukesh Ambani, Narayana Murthy, The Mahindras, Azim Premji, The Government of India itself get massive amounts of dividend income year after year on their Shareholdings in their iconic companies.

You can also build a steady stream of dividend income over a long period of time. Read on.

In these days where unemployment rates are on the rise and the incomes from salaries and rents have dwindled on account of unprecedented levels of pay-cuts and layoffs , it would be a great source of relief if you could build secondary sources of Income.

Also, as you age and get older, finding gainful sources of employment would become even more difficult. Building a portfolio of high dividend paying stocks over a long period of time would provide you with passive income during your twilight years.

This is where the dividends from your investments can help. Dividends provide a free and a continuous stream of income over long periods of time. Your retirement will be funded by the dividend income from your investments long after you have stopped working.

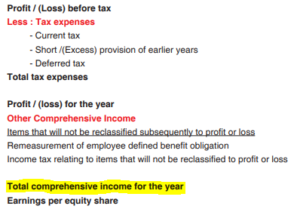

Dividends are a portion of profits made by the company that are paid out to shareholders every year or twice a year or multiple times of years depending on the dividend distribution policies of the dividend paying companies.

To become entitled to receiving dividends all one has to do is to open a demat account, buy shares of dividend paying companies and hold them at the time when the companies declare dividend. The dividend income would automatically get credited to your bank account within one month (as per law) from the date the dividend is declared by the company.

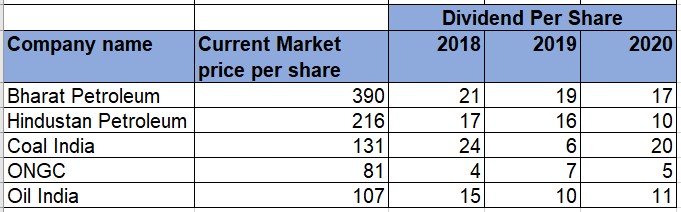

Besides, All Public Sector Enterprises (PSEs) in India have been mandated by the Government of India to pay 30% of the profit after taxes or 5% of Net worth whichever is higher as dividends to their shareholders. That is why the PSEs in India dole out huge dividends year after year. These companies which includes such big names as Bharat Petroleum, Hindustan Petroleum, ONGC, Coal India, Oil India etc., pay huge dividends. (Look at the table below in this article).

You can buy the shares of these companies especially when these are available at lower prices to become entitled to dividends almost indefinitely over long periods of time.

There are several Private Sector companies too, which pay out handsome dividends every year/twice a year.

Dividend Yield is calculated as Dividend Per Share divided by the Market Price of share at which it was bought. For example, if you bought the shares at Rs.100 per share and the company declares Rs.5 as dividend, the dividend yield will be 5/100 which is 5%. Most companies keep increasing their dividends payouts every year. So, if you hold the shares for a long time, the Dividend Yield on your shares would go up without you moving even a finger and these would be much better than the interest rates that you get on your fixed deposits.

Given below is a table showing the dividends paid by some Public Sector Enterprises in the last three years.

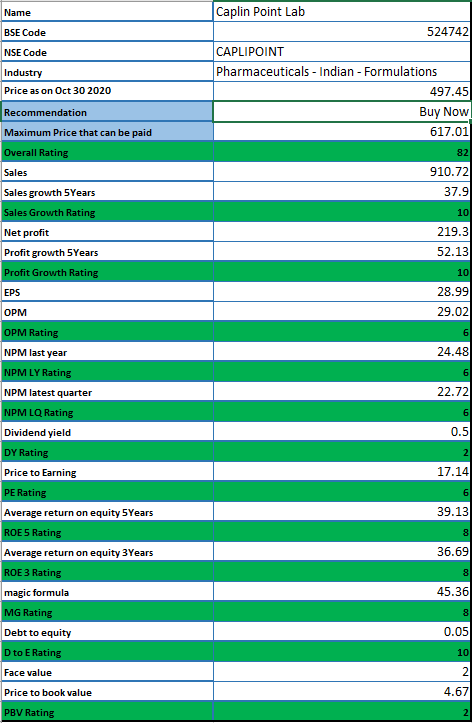

At https://Indiastockanalysis.com, we analyze and assign ratings to all stocks traded on BSE and NSE on several critical fundamental factors and also apply a margin of safety of 40% across the board to identify severely undervalued companies based on sound value investing principles. Dividend Yield is also one of the factors.

When you buy the shares of companies recommended by us , you would automatically become entitled to the dividends these companies declare as we exclude companies not paying any dividend from our analysis and ratings.