(The financials of CUPID Ltd (BSE Code 530843) are used as an example here. Cupid Ltd was one of the recommendations at Indiastockanalysis.com for the month of October 2020).

Cupid Ltd has a very stable business of predominantly producing male and female condoms besides other associated gels, sanitizers and creams. It exports them to several countries in the world. It has also applied for USFDA approval to market them in the USA. The company is debt free and has recently made a foray into production of medical test kits that would facilitate diagnosis of various ailments including Covid 19 symptoms. It is a very asset light company with a very clean balance sheet and generates substantial free cash flows every year.

In this article we will discuss how to determine the price that should be paid for any stock using the principles of Value investing. Most investors identify good investments but when it comes to paying the right price most of them are found lacking in this knowledge to arrive at the right price to pay. They buy good businesses at high prices.

The price that we pay determines how well our investments will perform.

At IndiaStockanalysis.com, we identify the price to pay for all the 3000+ stocks traded on BSE and NSE. We also take caution to exclude companies whose earnings are negative.

Earnings

Earnings made by the company is one of the most significant factors that influences the market price of any stock. A business that can grow its earnings significantly over a long period of time is viewed very favorably by the market. The market rewards the earnings generating capacity of the businesses.

Therefore, in arriving at the price to be paid, earnings is the most important factor and provides the starting point.

So, what is the meaning of Earnings for determining the right price to pay for any stock. We are interested in the earnings that remain after all expenses are met and which belong exclusively to the Equity Shareholders of the company.

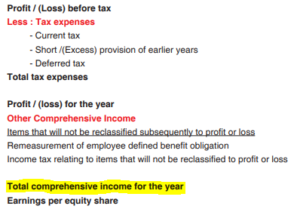

Excerpt from Cupid Income statement from their Annual Report

The highlighted line from the income statement above is what we are interested in. It is portion of the profit that belongs exclusively to the equity shareholders of the company. We would like to invest in a company that grows this number year after year.

And we use the TTM earnings on a Consolidated level.

TTM stands for Trailing Twelve Months. For example, if we are analyzing the stock in the month of November 2020, the TTM EPS would be the

EPS of September 2020+ EPS of June 2020+ EPS of March 2020+ EPS of Dec 2019.

For Cupid Ltd, the TTM EPS as of November 2020 is Rs.25.23

EPS Growth rate

The growth rate of a company would tell us how well the company has been able to increase its Earnings per share in the last five years. We are interested in finding companies that have been able to grow their earnings consistently over several years.

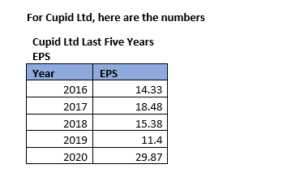

For Cupid Ltd, here are the numbers

The compounded EPS growth rate is therefore 20.16%

Cupid Ltd has a very stable business of producing male and female condoms. It exports them to several countries in the world. It has also applied for USFDA approval to market them in the USA. The company is debt free and has recently made a foray into production of medical test kits that would facilitate diagnosis of various ailments including Covid 19 symptoms.

EPS after three years

The next step in the process is to estimate the earnings for at least next three years using the growth rate for the past five years. It is difficult to estimate which way the company would go after three years. For our analysis, three years is the long term. We can adjust this as we move forward.

Do not worry now about this estimate. We will apply a Margin of Safety (one of the most important principles of Value Investing) to the final price that we should be willing to pay for this stock.

SO the EPS of Cupid Ltd after three years in 2022-23 would be Rs.51.82.

This is nothing but the TTM EPS compounded at the rate of 20.16% for three years.

Market Price after three years

This will be the EPS after three years multiplied by the current Price Earnings multiple (PE) for the stock. You can get the current PE multiple of the stock from the BSE website.

Current PE is 8.96.

Alternatively, we can also calculated the PE as the average of 52 week high and low prices divided by the TTM EPS in which case it would be ((295+115)/2) Divided by 25.23 which would be 8.12. However, we take the Current PE ratio.

Therefore, Market price of the Share after three years in March 2023 is likely to be 51.82 times 8.96 which is Rs. 464.

15% minimum expected return

As value investors, we would need at least 15% after tax return on our investments.

Now we estimate, how much should we pay now, so that at a compound rate of 15% per annum it becomes Rs.464 after three years.

At IndiaStockANalysis.com, we perform these calculations for all stocks traded on the BSE and NSE stock exchange so you don’t have to do it.

For Cupid Ltd, the Price that we should be willing to pay that would amount to 464 after three years is

464/1.15/1.15/1.15 which is Rs.305.

Rs.305 invested now grows to 464 @15% rate per annum.

Margin of Safety

We should never pay a high price for any stock. So we will NOT pay Rs.305 for it.

This is the bottom line of all value investing principle. NEVER NEVER NEVER Overpay for any stock.

The above is a good estimate but it is an estimate nonetheless. The numbers that we expected might change over the years. Therefore, we want a good margin of safety of at least 40% should something go wrong with our estimates.

For class A group stocks, we have less margin of safety of 30%.

So, the price that we should be willing to pay is Rs.305 times 0.60 which is Rs.183.

Rs.183 is the maximum price that we should be willing to pay for this stock.

What next

But Cupid is now going at 225 as at the time of this writing. So, should you buy Cupid.

The answer is a resounding No. We should not be willing to pay anything more than 183 for that stock. When it comes to 183 or thereabouts, buy a huge quantity of shares in it – Buy a part of the business if you like their business. Make your research efforts pay.

Add this company to your watchlist and keep monitoring it until it reaches Rs.183 and when it gets there make a BIG investment and have the courage to hold it for next three years. This is how real wealth is created from the stock markets. Besides, you will also be rewarded with the dividends that this company pays over these years. Currently, Cupid pays a healthy dividend of around Rs.4.50 per share.

This courage to hold comes from conviction in our analysis.

Once you buy the shares, monitor the company like a Hawk. Read every announcement that it makes, pour over its quarterly results, Read the earnings call transcripts, Understand the quarterly financial statements and see the trends and decide whether the company still has all the characteristics intact that made it to the Buy list now.

At Indiastockanalysis.com, we help you identify the Right Price to pay for all Profit making stocks that trade on the BSE and NSE. We also rate stocks based on several fundamental parameters. Cupid was the fifth best stock in our October 2020 recommendations.

Happy Investing.