October 2020 Reco- Caplin Point Labs

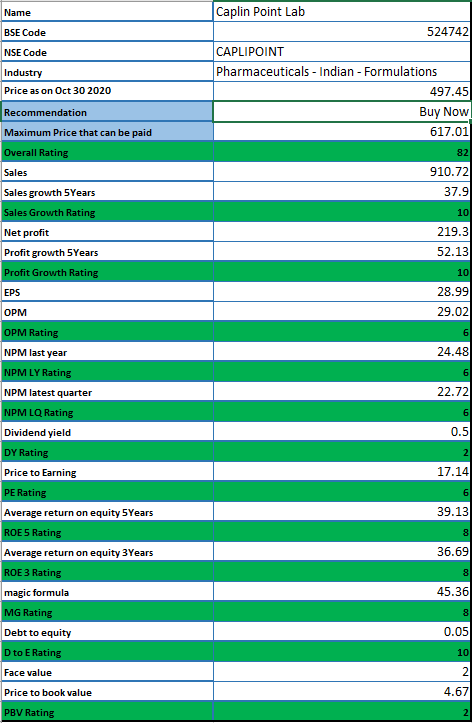

Here is a snapshot of Caplin Point Labs and its rating and analysis

Out of the 3000+ companies analyzed for the month of October 2020, Caplin Point Laboratories has stood out as one of the buy recommendations based on our analysis and comprehensive rating system. We recommend 10 such stocks every month which excel on all identified parameters. These stocks can help create sizeable wealth if held for a minimum of three years at the least.

What follows below is an explanation of why this company was chosen for a “Buy” recommendation in the month of October 2020.

You can scroll all the way down to read the conclusion 🙂

About Caplin Point Labs

Caplin Point Laboratories Limited is possibly the only mid-sized company in India’s pharmaceutical sector to be engaged in the manufacture of APIs, finished formulations, research & development, clinical research, frontend generic presence in Latin America, brand marketing in Francophone Africa and a USFDAapproved injectable facility.

The Company’s asset-light marketing business model has helped generate the resources to build world-class infrastructure.

The Company’s debt-free and cash surplus situation positions it attractively to address the opportunities of the future.

Sales Growth Rating (10/10)

Sales have grown at a CAGR of around 38% in the last five years. The TTM (Trailing Twelve Months) sales as at the time of this recommendation was Rs.911 crores.

At IndiaStockAnalysis.com, we give a maximum rating of 10 for sales growth greater than 30% in the last 5 years. So this company got a rating of a perfect 10.

Net Profit growth rating (10/10)

The Net profit has grown at a CAGR of 52% over the last five years. The TTM net profit as at the time of this writing was Rs.219 Crores.

We give a high rating of 10 to companies where the net profit has been showing a steadily growing pattern over the years. Therefore, on this front, this company gets a full rating of 10.

Operating Profit Margin (OPM) rating (6/10)

The Operating profit margin of the company has been around 30 to 33% in the last five years. It gets a rating of 6 on this parameter. Operating profit represents earnings before finance charges, taxes , depreciation and Amortization. This explains how well the company has been able perform on an operational basis to maintain or grow its Gross profit margins.

Net Profit Margin Last Year and Latest quarter rating (6/10)

The Net profit is what is available to the shareholders of the company after all the expenses have been paid out. The higher the net profit margin the better it is for the shareholders. At IndiaStockAnalysis.com, we shortlist only those companies that have at least 8% as Net profit Margin. On this front, this company gets a rating of 6 out of 10. It has been maintaining a healthy net profit margin of over 20%.

Dividend Yield (2 /10).

Even though this company is cash rich and is debt-free, it is not known for paying generous dividends. The company has retained cash for expansion and acquisition purposes. In the year 2020-21 , it has paid a dividend of Rs.2.50 so far. However, one thing to note is that the dividend per share is showing an increasing trend (from Rs.1.50 in 2017 to Rs.2.50 in 2020-21).

Price to Earnings Rating (6/10)

Price to Earnings measure how expensive the company is when we compare its Earnings per share against its Market price. For this company, the PE ratio is around 17. Considering the fact that this company has been growing its Sales and Net profits at a considerable pace, on the PE ratio front, it gets a rating of 6. Companies with lower PE ratio get a higher rating.

Return on Equity for 5 and 3 years Rating (8/10)

Return on Equity measures how well the company is able to use its Equity resources to earn profits for the Shareholders. In order to get a good grip on the return on Equity we measure both Average return on Equity for 5 years and also for the last three years. The higher the return, the higher the rating. Caplin Point has a rating of 8 on this front.

Magic Formula (8/10)

Magic Formula is a concept popularized by Joel Greenblatt in his famous book The Little Book That Beats the Market. This is a combination of Earnings Yield and the Return on Capital Employed. In effect, this ratio tells us how well the company has been employing its capital (both Equity and Debt) to generate profits for the Shareholders.

On this front, it has a rating of 8 out of 10.

Debt to Equity (10/10)

At Indiastockanalysis.com, we do not favor companies that employ excessive amounts of debts (both long term and Short term) on their balance sheet. We give a very low rating to companies with High Debt to Equity. Caplin Point has no debt on its balance sheet. Therefore it gets a rating of 10 on 10.

Price to Book Value (2/10)

The market price to book value per share measures the Market price against the Intrinsic worth of the company. However, this is a traditional measure. Book value is not fully representative of the real realizible value of the assets/liabilities of a company. However, at Indiastockanalysis.com, we favor companies and highly rate the ones that have low Price to Book Value. On this front, Caplin point scores 2 out of 10.

Conclusion

So this stock of Caplin Point Laboratories has an overall Rating of 82 out of 100. It is no doubt a wonderful company. But is the price attractive enough to buy this.

At Indiastockanalysis.com, our objective is to identify wonderful companies and MORE IMPORTANTLY to recommend buying them at attractive prices.

So should you go and buy it. No. Not until you know what is right price that can be paid for it.

This is where most investors make mistakes. Most of them do not know what is the right price to pay for the stock.

But we will help you find this.

Caplin Point’s EPS as at the end of March 31, 2020 is Rs.26.13

Its Average rate of Return on equity has been around 35% in the last five years.

Assuming it can grow it at the same rate over the next three years (do not worry we will also add Margin of Safety and that should take care if our assumptions go wrong), its EPS in March 2023 would be

26.13 times 1.35 raised to 3 which is Rs.64.

The Current PE ratio for this company is 17.

At this PE, at the end of March 2023, this company will be quoting at 64 times 17 around Rs.1088.

If our objective is to earn 15% return for the next three years , we should be willing to pay nothing more than Rs.715 (that is the present value of Rs.1088 discounted at 15% for three years).

Lets add a Margin of Safety of 30% to this price, so we get a price of Rs.500.

Rs.500 is the right price to pay for this stock to earn a rate of 15% return at a margin of safety of 30%