sdfgsdfg wert wert656

Determining the right price to pay for any stock (Click this link)

Our analysis of Tyche Industries Limited (Click this link)

How to avoid common investing mistakes

Stock market is a good teacher. All you need to make money from stock market is to be its good student and avoid common investing mistakes. Even expert investors make these mistakes time and again. The mistakes could be costly and may lose a lot of wealth over long periods of time.

At https://indiastockanalysis.com, we analyse, rate and recommend stocks based on a rating scale of 100 for all stocks traded on the BSE and NSE. We eliminate all stocks that made any loss in the last five years from our analysis so that you get to invest only in great companies at reasonable prices. We also suggest for each stock the right price to pay.

To subscribe at our website and get stock recommendations, follow this link

https://indiastockanalysis.com/shop/

What are these mistakes and more importantly how to avoid them.

Not sticking to a plan : Not many people have an investing plan. They do not clearly lay out or do not have a clear understanding about their long-term goals. Without a clearly written down plan, it is difficult to take steps to achieve them.

Therefore, it is imperative , that you must have a clearly laid out financial goals that you want to achieve. That would give clear indications about how much to invest , in what kind of securities and for how long before the goal is realized. Having a clear financial plan, also enables one to take a longer-term view of things and avoid making irrational and costly mistakes in the short term.

Starting too late : Investments need time to grow. The best time to start investing is in your 20s. The more time you have on your side, the more are chances of making the compounding work in your favor.

Rs.1,00,000 would grow to only Rs.2,59,374 @ 10% per annum at the end of 10 years but the same

Rs.1,00,000 would grow to Rs.6,72,750 @ the same 10% per annum at the end of 20 years.

Emotional responses : Stock market can take one on a roller-coaster ride. Emotions of greed and fear rock the investors and make them commit grave investment mistakes. Buying high when the prices have gone up already and selling low during panic driven by global downturns, unfavorable political and economic news, are the most common. While buying high , potentially limit the gains and increase the scope for losses , selling low is outright stupid and makes one book a permanent loss. Others sell two early and are happy with the profit they have booked on the sale.

For example, in the March of 2020 when lockdowns were announced globally, several stocks hit all time and 52-week lows. This created panic among the investors, and they sold most of their great investments and booked permanent losses. This is literally throwing hard-earned money down the drain. This was an emotional response to a previously unknown situation and is counterintuitive. Great companies were available at throwaway prices. As per logic, we should be buying low and selling high. But the emotions took over and made investors sell good quality stocks in panic at lower prices.

These kinds of emotional responses can be avoided only when there is a clearly laid out and written long term goals. Stock markets have gone through lows and massive sell-offs time and again, but they have always bounced back and breached the higher levels previously attained. What is more needed during such times is patience and a strong resolve to commit and stick to the longer-term goals.

Not investing enough : This is a very common mistake. Either people do not invest or do not invest enough to make substantial gains from the stock markets. There is difference between earning a 40% return on Rs.1,000 versus let us say the same 40% on Rs.1 lakh. The higher you invest, the greater are the changes of making absolute financial gains.

In order to ensure that a good amount is invested to take care of your longer term needs, it would do well to start a SIP (systematic investment plan) in any equity shares of your chosen company. Most brokerage houses , these days offer SIP facility to invest a chosen amount at regular intervals in any shares of your choice. Younger investors should invest more in stock markets than older investors who are closer to retirement or already retired.

Buying and selling too often: These are very common mistakes. The trading websites lure people to buy or sell too often so that they can earn more brokerage. Investors buy good quality scrips at reasonable prices but do not hold long enough to earn any substantial gains from them. They sell it too early and jump ship and buy some other stock recommended by some other advisor. This constant buying and selling loses a lot of money over long periods of time in fees, brokerages and short term capital gains.

Sticking to a long-term plan would help avoid this.

Not enough diversification : Putting all eggs in a single basket is never good. Some people invest everything they have in a single stock. They fall in love with that company. Their fortunes will be tied to that stock. Any significant decline would wipe out their hard-earned money. Unless one has a great understanding of the underlying business of the company they have invested in and constantly monitor the performance of those companies, it would do well to diversify.

It would be better to invest in a mix of equity, gold, real estate so that the losses in any one asset class could be offset against profits from the others.

Not holding good quality stocks for long term : Significant wealth could be made from stock markets only when the stocks of great companies are bought at lower prices and held for significantly long periods of time. Do not make any investment if you are not willing to hold the stock for at least three years. For example, Infosys stock bought in 2002 and held until today in 2021 would have provided a return upwards of 30% per cent per annum (including dividends). Such returns over significantly long periods of time can be earned only when the stocks of great companies are bought at reasonable prices and held for long term.

Investing in poor quality stocks: This common mistake alone has lost a lot of investor wealth over several years. Not many investors research stocks before buying. Most of them buy stocks based on some tips or recommendations from unqualified sources without having a basic understanding of the business of the company, its products and financials.

Most of them do not even have a clue of what business the company is in or what their products are, how the management is, what the capital structure of the company looks like, their customers, their last few years financial performance and whether price paid for the stock is the right price. Such lack of knowledge, inability to do due diligence in the stocks they buy, and hold could prove catastrophic.

At https://indiastockanalysis.com, we analyse, rate and recommend stocks based on a rating scale of 100 for all stocks traded on the BSE and NSE. We eliminate all stocks that made any loss in the last five years from our analysis so that you get to invest only in great companies at reasonable prices. We also suggest for each stock the right price to pay.

To subscribe at our website and get stock recommendations, follow this link

The Power of Watchlists

The Power of Watchlists

Value investors create and update watchlists periodically. The power of watchlists cannot be underestimated.

At https://indiastockanalysis.com, along with stocks that are ripe for buying at the right price, we also suggest adding up to 20 or 30 stocks of great companies to watchlist. These 20 or 30 companies have already been thoroughly studied but are not on BUY recommendation because the market price of these shares is higher than Price to pay that we arrived at. Therefore, these go to “Add to Watchlist” recommendation. You can add them to watchlist (more on how to create a watchlist as you read further down) and buy them when the price is right. We also indicate for each stock what is the right price to pay. This price contains 40% margin of safety.

Watchlists contain stocks that are potential buys but are not great buys yet. Preparing a watchlist of stocks to buy later would also avoid impulse buying based on some tips or recommendations. You must absolutely avoid impulse buying without studying anything about the company. Making such purchases on impulse would be highly unadvisable.

You read about a company in some magazine, or on some blog, or on some portal and at that time you like what you have read about it. You would want to analyze this company in more detail later when you are free. Until that time , you put that company on a watchlist.

You must build a watchlist of good stocks over a period. Your broker might provide you with a facility to create and update watchlists. Hdfc direct, ICICIdirect.com, Zerodha and all other brokers allow you to create watchlists.

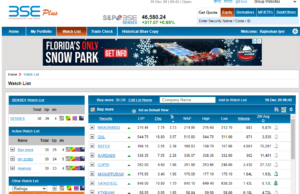

The best watchlist that you can create for free is on bseindia.com. Here is the link

https://bseplus.bseindia.com/WatchList/WatchListHome.aspx

At the BSE website you can create multiple watchlists and in each watchlist you can add up to 30 stocks. You can make any three of your watchlists active at any time. That is , you can actively track up to 90 stocks. That is a huge number. The daily announcements, Corporate actions like dividends, bonus etc., and the results when declared by the companies on the watchlist are updated regularly.

Here is a sample from the Bseindia watchlist

When the stocks in your watchlist trade around the right price to pay (as per our recommendation), you buy that stock at that price but until that time it remains in the watchlist.

Similarly, you can also remove stocks from the watchlist. For example, a stock added by you to a watchlist is raided by the Income tax officers anytime or it has suffered huge losses in the quarter which are not of a temporary nature. You should remove such stocks immediately from the watchlist and not track them anymore.

At https://indiastockanalysis.com, we do not touch stocks that have governance issues or which have made a loss in any of the last five years. Such stocks are dangerous and can lose a lot of money for the investors. Therefore, once you buy the stock, you need to read all the announcements that the company issues out every day- at least once a week. If you notice any red flags (such as Income tax raids, Search and seizure, The Managing director of the company arrested and sent to Jail, Sales and profits declining substantially in any quarter without a reason), then immediately sell and book the loss if you bought the shares or remove it from your watchlist if you have added it there.