The Power of Watchlists

Value investors create and update watchlists periodically. The power of watchlists cannot be underestimated.

At https://indiastockanalysis.com, along with stocks that are ripe for buying at the right price, we also suggest adding up to 20 or 30 stocks of great companies to watchlist. These 20 or 30 companies have already been thoroughly studied but are not on BUY recommendation because the market price of these shares is higher than Price to pay that we arrived at. Therefore, these go to “Add to Watchlist” recommendation. You can add them to watchlist (more on how to create a watchlist as you read further down) and buy them when the price is right. We also indicate for each stock what is the right price to pay. This price contains 40% margin of safety.

Watchlists contain stocks that are potential buys but are not great buys yet. Preparing a watchlist of stocks to buy later would also avoid impulse buying based on some tips or recommendations. You must absolutely avoid impulse buying without studying anything about the company. Making such purchases on impulse would be highly unadvisable.

You read about a company in some magazine, or on some blog, or on some portal and at that time you like what you have read about it. You would want to analyze this company in more detail later when you are free. Until that time , you put that company on a watchlist.

You must build a watchlist of good stocks over a period. Your broker might provide you with a facility to create and update watchlists. Hdfc direct, ICICIdirect.com, Zerodha and all other brokers allow you to create watchlists.

The best watchlist that you can create for free is on bseindia.com. Here is the link

https://bseplus.bseindia.com/WatchList/WatchListHome.aspx

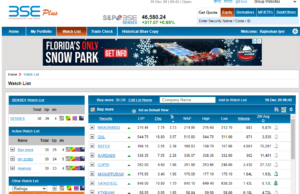

At the BSE website you can create multiple watchlists and in each watchlist you can add up to 30 stocks. You can make any three of your watchlists active at any time. That is , you can actively track up to 90 stocks. That is a huge number. The daily announcements, Corporate actions like dividends, bonus etc., and the results when declared by the companies on the watchlist are updated regularly.

Here is a sample from the Bseindia watchlist

When the stocks in your watchlist trade around the right price to pay (as per our recommendation), you buy that stock at that price but until that time it remains in the watchlist.

Similarly, you can also remove stocks from the watchlist. For example, a stock added by you to a watchlist is raided by the Income tax officers anytime or it has suffered huge losses in the quarter which are not of a temporary nature. You should remove such stocks immediately from the watchlist and not track them anymore.

At https://indiastockanalysis.com, we do not touch stocks that have governance issues or which have made a loss in any of the last five years. Such stocks are dangerous and can lose a lot of money for the investors. Therefore, once you buy the stock, you need to read all the announcements that the company issues out every day- at least once a week. If you notice any red flags (such as Income tax raids, Search and seizure, The Managing director of the company arrested and sent to Jail, Sales and profits declining substantially in any quarter without a reason), then immediately sell and book the loss if you bought the shares or remove it from your watchlist if you have added it there.